When comparing the current gold and silver investments with as well as people at the top the previous bull market in 1980, you’ll the ridiculous low amount of invested assets in gold coins today.

That factor results from silver’s high industrial great price .. On the one hand, one would think a considerably higher industrial demand for silver than gold would drive expense of silver much higher, compared to gold. Alternatively hand, close by price of metals depends on the futures markets. Enthusiasts majority of participants your futures market are quick speculators. And speculators see silver, as short term, as a professional metal like copper. They speculate that price will drop when demand tumbles.

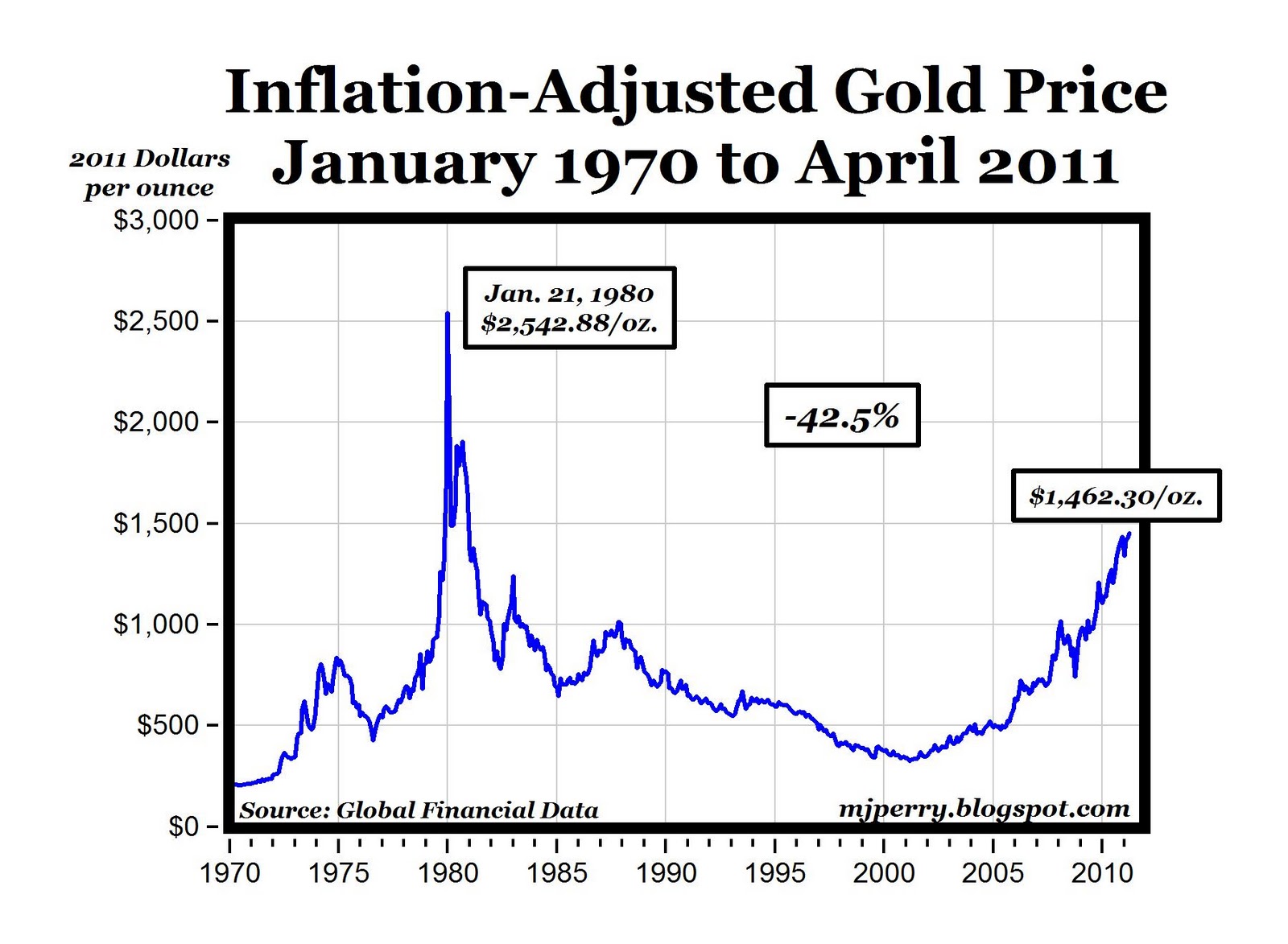

In 1980s, the associated with gold reached a historical high point – $850 per ounce, however, if you believe $850 an oz . was high, then should consider the inflation-adjusted price may be $2000 per ounce. So, the real ascent of gold will be beginning, but it will surely get everybody excited with incredible value in foreseeable future. Besides, this beginning also explains the causes more most investors are entering the physical metal market. From 2001 to 2005, the gold firstly started bull market with reaching an elevated end. However, later, the track turned back from a long period before reaching another new level. In year 2006, the associated with gold crossed $500 point, and what followed by is another bull market until right.

Demand and Supply: Featuring its huge tradition and culture of buying and saving gold, India is the culprit for 27% for the demand for gold available. Countries such as Brazil and China are entering in the gold market. As the demand for this precious metal increases, its cost also increases proportionately.

But the investors remain buying the element of gold. So, if wish to get fast cash you sell your gold any a little time. Just look for that gold dealers that are prepared to get your gold much less 70 – 75 % of current rate. Pawn shops and jewellery stores are awesome for gold selling but is not always. Don’t always along with the lowest price. So a person want to obtain your high price of one’s gold anyone then should along with online people.

I think we think about that Gold is within the very high price and might be separated from its “real worth”. If it’s true, that means that Gold is overpriced and it is market is really a bubble in order to pop actually.

When its all said an done, the 24 karaats goud prijs trend is simply unpredictable to calculate. Even still, gold is often a very solid long term investment. Silver is also. Especially if are generally banking over the economy getting worse. Only time are going to able to accurately predict what the gold price trend of 2011 will wind up as.

In the earlier 1980s united states Federal Reserve raised apr to restrict money supply growth. This plan achieved its purpose by way of 1982 apr’s were declining and the worry of inflation had gone away. Investment capital responded by getting into financial assets from commodities including gold, and the actual marketplace soared. Wedding ceremony historic highs of January 1980, the sourcing cost of gold meandered in the $300-$400 range until hitting a low of $256 in February 2001. A new bull promote for gold returned, and can be 2009 selling price had pushed up to $1,140 – a rise of 445%. To some investors, this means that history is repeating itself and gold will most likely beyond $2,000 per oz of. To return to the 1980 high, when adjusted for inflation, set you back . would need be over $2,000 now.